Category: Farm Report

The $147 Million per Year Story

On February 18, Republicans in the House of Representatives defeated an obscure amendment to the House Appropriations bill by a 2-to-1 margin. The Kind Amendment would have eliminated $147 million dollars that the federal government pays every year directly to Brazilian cotton farmers. In an era of nationwide belt tightening, with funding for things like education and the U.S. Farm Bill on the chopping block, defending payments to Brazilian farmers may seem curious.

Farmland and Flooding

Three professors from Southern Illinois University have written President Obama asking him to leave the Bird’s Point Levee open for wetlands creation. The article is a reaction from the Delta Farm Press. It is a good example of the problems with agricultural and climate change politics.

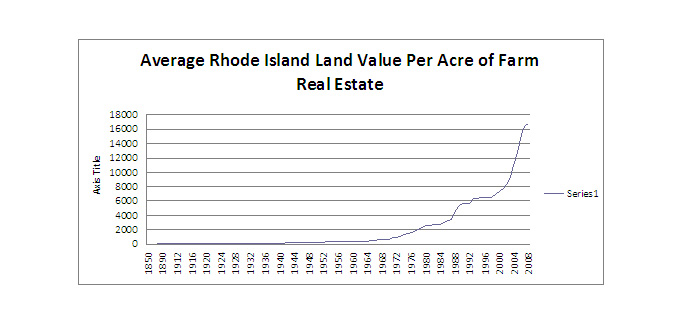

Rhode Island Farmland Values

How Goldman Sachs Created the Food Crisis

A perhaps narrow-minded (a number of reasons for food cost increases), but still informative article on commodity price increases. If you believe what it reports, it is a startling commentary on shortsided human greed. I’m interested to hear any other insights.

The money tells the story. Since the bursting of the tech bubble in 2000, there has been a 50-fold increase in dollars invested in commodity index funds. To put the phenomenon in real terms: In 2003, the commodities futures market still totaled a sleepy $13 billion. But when the global financial crisis sent investors running scared in early 2008, and as dollars, pounds, and euros evaded investor confidence, commodities — including food — seemed like the last, best place for hedge, pension, and sovereign wealth funds to park their cash. “You had people who had no clue what commodities were all about suddenly buying commodities,” an analyst from the United States Department of Agriculture told me. In the first 55 days of 2008, speculators poured $55 billion into commodity markets, and by July, $318 billion was roiling the markets. Food inflation has remained steady since.

Declining Crop Yields

Michael Roberts, a resource economist at North Carolina State University, takes a look at what he calls ‘ a pretty rapid slowdown in productivity growth’.

http://greedgreengrains.blogspot.com/2011/05/declining-crop-yields.html

Factory Farms and Antibiotics

A well-researched article on factory farms, antibiotic use in animals, and the implications to humans.

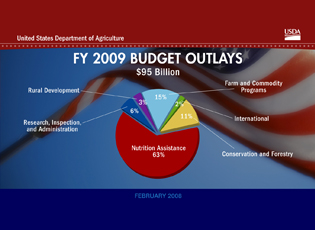

USDA Budget

Chicken Manure

An interesting set of Frontline interviews with various parties commenting on Chesapeake Bay chicken operations.

http://www.pbs.org/wgbh/pages/frontline/poisonedwaters/themes/chicken.html

Food Safety?????

An article on HR 875 The Food Safety Modernization Act of 2009