We met on Wednesday with two folks at the Rhode Island Foundation. They are trying to do a good job.

The Foundation is a public trust established many years ago by a local bank which now has around $600 million in assets – 60% are open, 40% are to benefit specific objectives. They appear to be trying to do a good job.

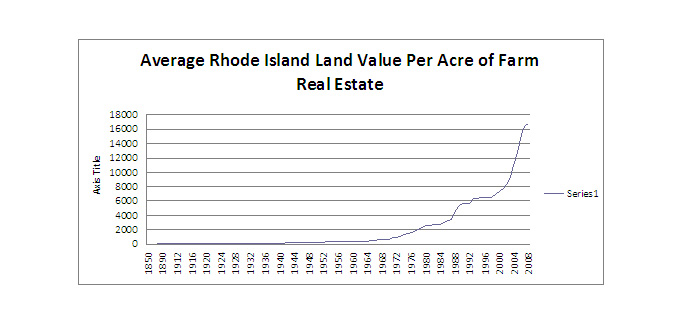

Because we are working on development of a farmland real estate fund in the State, Peter and I have been discussing our planning progress with them – thinking the venture would be of interest to them.

As part of determining how they use money (in order to better know them), I had requested a listing of their investments. I was told they usually do not disclose their investments. They did disclose that they have about $13 million in a number of program related investments (sounds like mainly loans) which evidently they manage themselves.

1) $600 million is substantial.

2) How much of their portfolio is invested in Rhode Island based enterprise?

3) Since it is a Rhode Island public trust, would it not be appropriate that all of their assets be invested in Rhode Island based enterprises?

4) Do they have sustainability and social responsibility criteria for their investment portfolio?

Obviously, they hire professional investment managers to reduce their exposure to risk while providing the best possible return. Those managers are taking a ‘whole earth’ look at the investment universe. They state that they are trying to maximize return in order to have more money each year for grants.

Obviously Number 2, their money management is consistent with most foundations, institutions of higher education, etc.

I bring this up because it is indicative of a broad set of practices that have evolved as a result of contemporary investment banking and the idea of ‘ownership’ -particularly ownership in corporate equities and the enormous number of variations that professional investors (hedge funds, etc.) have cooked up in the last twenty five years. The result is that foundations, NGOs, institutions of higher education, pension funds, and many smaller endowments are now ‘invested’ in these equities, various funds, various bonds and bond funds, etc.

Even if you look at bonds and corporate equities – perhaps the most simple to analyze – the fundamental underlying value is only one of many factors related to the value of ownership…the pschology of the market, outside ratings, etc. drive price…and therefore worth. We now have a relatively abstract ownership culture made up primarily of these kinds of institutional investors, a small group of wealthy individuals, and sovereign wealth funds. Avoiding risks now means ‘hedging’ your ownership.

I suggest a different ownership culture…where ownership is active collaboration with socially meaningful enterprises (developing criteria for ‘social meaningful’ is already going on in a number of circles). The best risk hedge, in my humble opinion, is active involvement and knowledge with enterprise development.

When I think of the total asset value of the Rhode Island Foundation, the Champlin Foundations, the Rhode Island Pension Fund, Brown University and a number of other smaller local endowments, I realize it is very substantial. They invest those monies based upon what they all believe to be the best possible use of funds. From my perspective, that ‘best possible use of funds’ has become too abstact for local needs.